SUMMARY

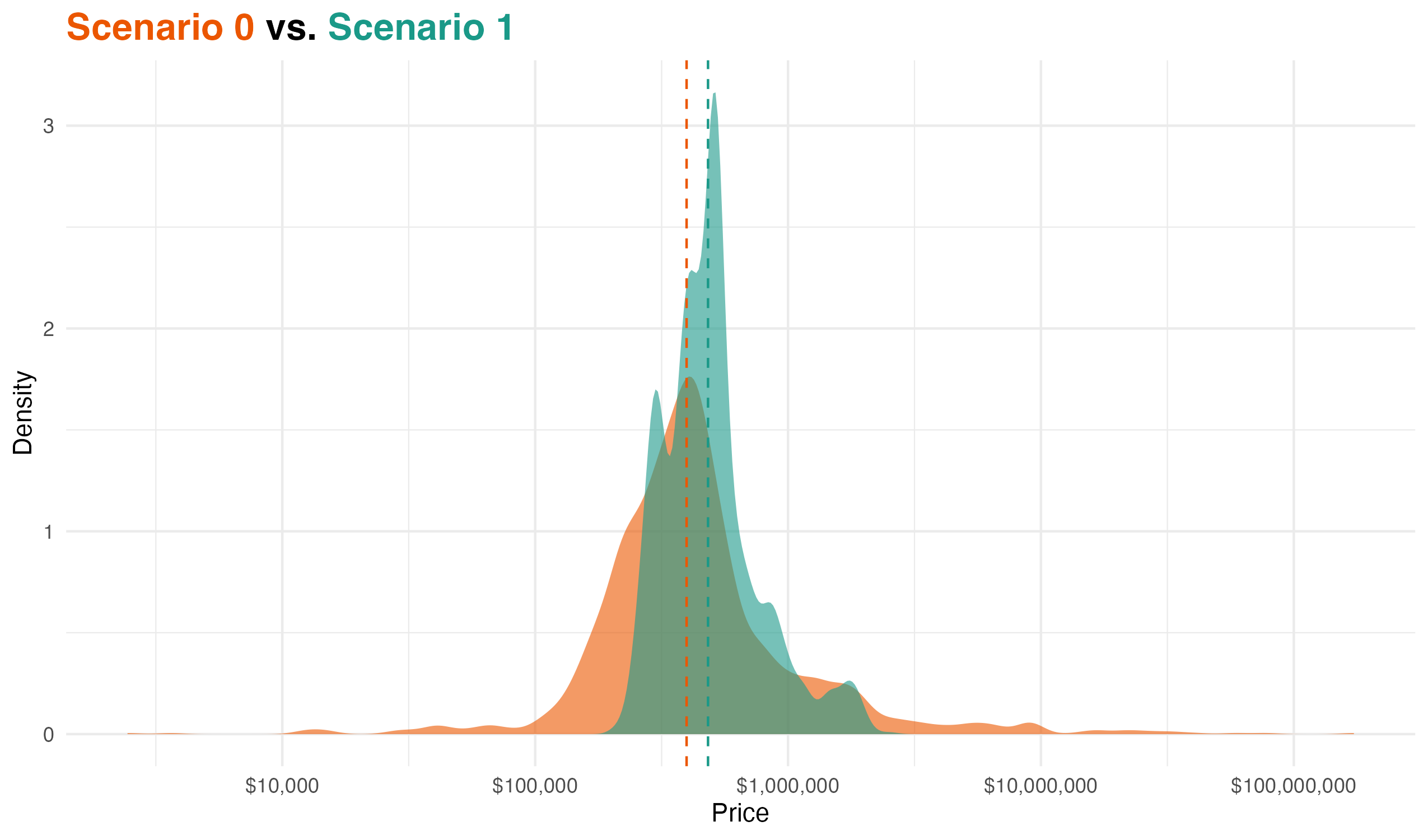

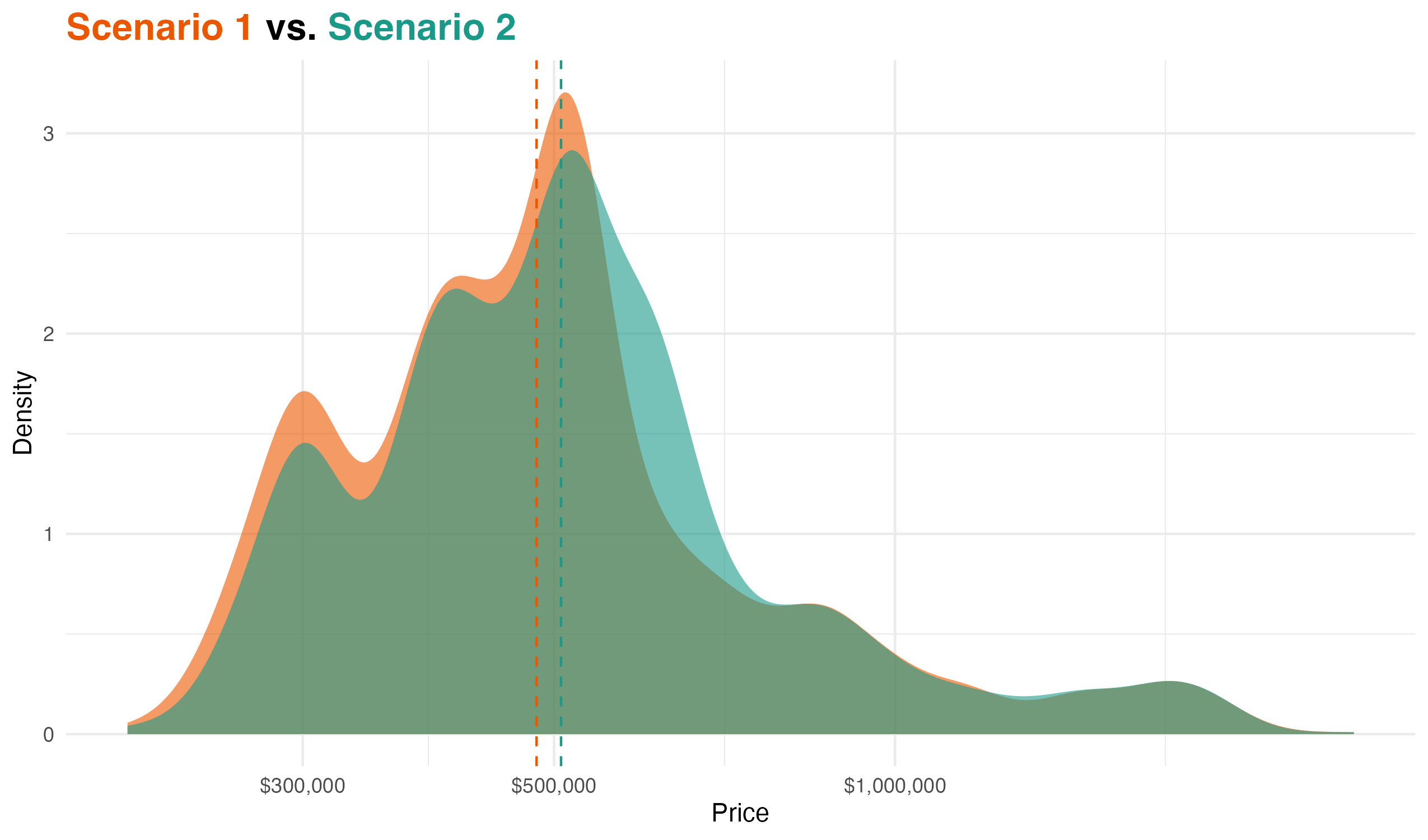

Median Values

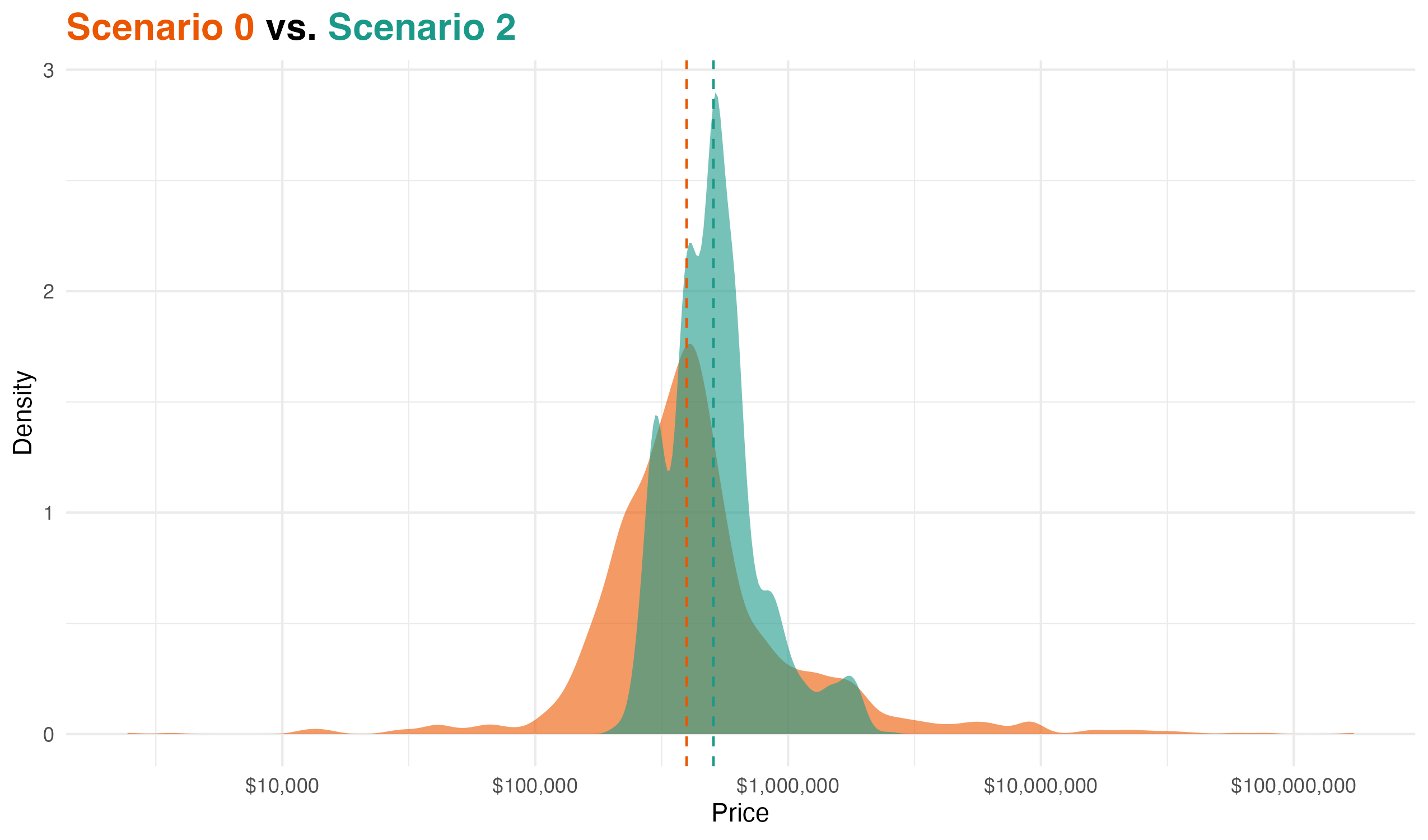

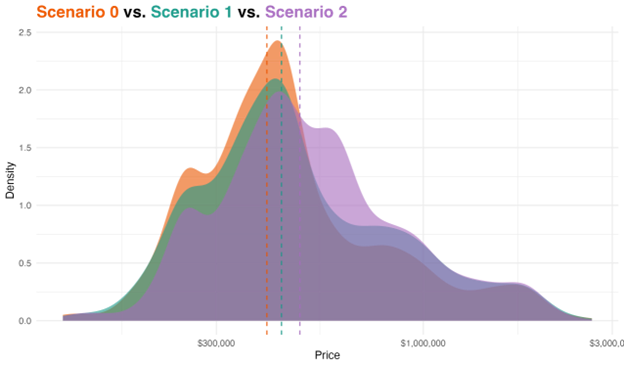

median_S0:

$402561; median_S1:

$438338; median_S2:

$487683

Each phase of intervention contributes incrementally to property value change. Physical improvements alone offer moderate benefits, while combining them with land use changes produces broader market responses.

What We Found

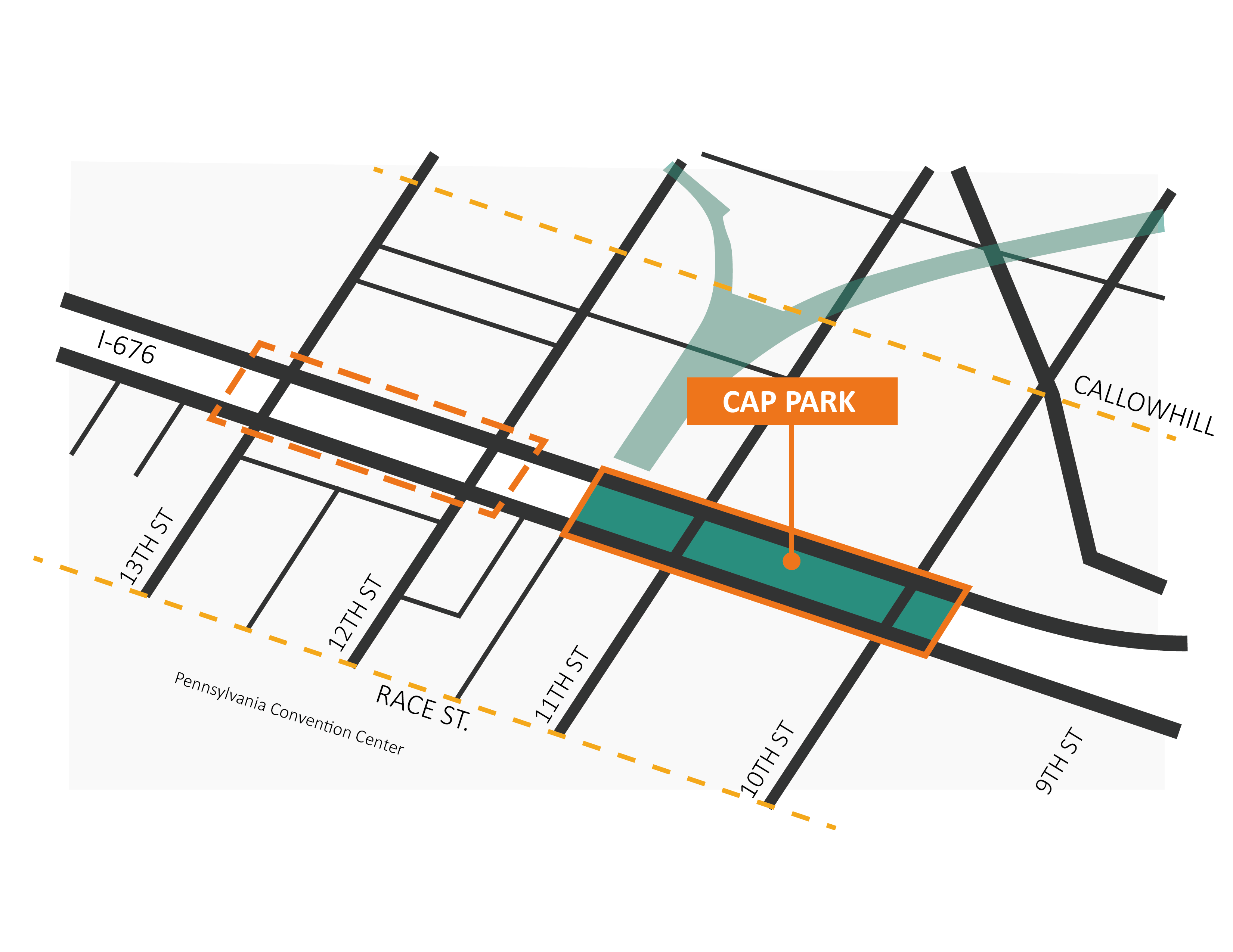

South side areas, especially the parcels located near the proposed park cap and close to the highway, showed the most significant property value increases in our analysis. These increases appeared in both the scenario with physical improvements only and the one with both physical and zoning changes. The price increases in these parcels reflect strong market demand and suggest that the area is already prepared to support more intensive land use. However, this also raises concerns about rising market pressure on existing residents and businesses.

In contrast, parcels on the north side of the highway continued to show declining values even when zoning changes were applied. Our findings indicate that zoning policy alone does not generate value increases in areas with weak infrastructure or limited access. Some parcels farther from the highway began to increase in value, which highlights the importance of considering physical conditions like street connectivity and transit access. Without additional investment, zoning changes alone are unlikely to create equitable development on the north side.

Our analysis also showed that not all value increases are beneficial. If new growth focuses only on high-end commercial or residential development, it may bring investment but also increase the risk of displacement. For growth to truly serve Chinatown, it will be designed to protect the community and ensure existing residents benefit from new improvements.

What Will Be Done to Protect the Chinatown Community?

Our project is not only about identifying where prices may rise. It is also about informing how public agencies can support development that prevents displacement and protects long-time residents. Property value increases, if not managed carefully, can lead to the loss of affordable housing. But when tracked and addressed early, these increases can serve as warning signs and guide protective policies.

We recommend that city agencies monitor price changes in areas where values increase rapidly. These parcels should be prioritized for early interventions such as rent stabilization, affordable housing protections, or tax support for long-time owners. With early action, rising prices do not have to mean rising displacement.

We also encourage the city to focus new development in areas that are already prepared for growth, such as the south side parcels near the park cap. These areas show high potential and can absorb new development without displacing current residents, especially if paired with infrastructure support and thoughtful design.

Meanwhile, areas where values remain low, especially on the north side of the highway, should not be overlooked. These parcels require more than just new zoning. They need investment in transit access, walkability, and public services to become viable for future growth. Only by addressing these needs can development happen in a way that is fair and sustainable.

Building a Fair Future for Chinatown

This project has always been about more than just changes in land use or urban design. It is about making sure that any improvements benefit the people who already live and work in Chinatown. Through all the analysis, one message is clear: smart planning and early action can reduce harm and increase opportunity. If future development is guided by what we have learned, the Chinatown Stitch can reconnect more than streets. It can reconnect people, protect communities, and support a neighborhood that grows without leaving anyone behind.